The One Tool That Jumpstarted My Leap to Full-Time Self Employment – and How I Use It for my Business!

Before I jump into the specifics of the tool I want to introduce you to, first let me give you the background story, which all started with a big move. In 2014, my husband applied and got accepted to a Ph.D. program that prompted us to pick up and move 10 hours away from home to go to Rochester, NY.

Because his program was in the sciences, where they pay you to go to grad school, it made financial sense for us to make the leap and see where things took us.

Before moving, I interviewed and was hired on for a job, so we felt pretty comfortable in making the decision to take the next step in buying a house.

Combining our Finances

Keeping on trend with all the big life and financial changes we were making, we thought, “What the heck, let’s combine our finances!”

Having been married for a few years, coming together in this crucial aspect of our lives felt like a natural progression, but I knew we needed a system and a way to keep everything on track to help 1) prevent disagreements and 2) continue moving forward and growing together.

For the record, before our commingling of finances, I had no interest in knowing what my husband was spending on his stuff nor did I want him to know how much I spent on things – especially home decor. Hence, needing a tracking system.

So, I started looking for a budgeting program of some sort and looked at quite a few including the Dave Ramsey envelope method, which didn’t appeal to me because I spend cash faster than I do anything.

Then, I vaguely recalled hearing about zero-based or zero-balanced budgeting. I wasn’t sure on the specifics but had a feeling it was what I wanted to do – to budget to zero every month so we would know where all our money is and where it’s going.

Finding the Right Software

As I started researching the concepts of zero-based budgeting and looking into various programs and software, I discovered You Need a Budget (YNAB), which stood out among the sea of other budgeting and money management tools.

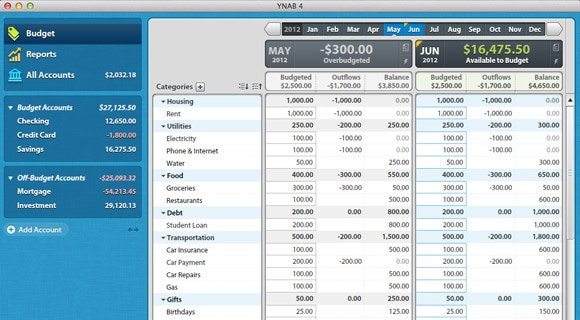

This is classic YNAB – the one I use – they have a fancy new internet software with a cleaner UI. (Also, not my budget! This is sample pulled from their site.)

The first thing to love about YNAB: they had a decent free trial, which was perfect for someone like me looking to try a whole new approach to money tracking.

A few days into the trial, I signed up for a tutorial that came via email and introduced me to their “rules” – a lot of which were common sense and things I was already doing, but I hadn’t formally acknowledged that I was practicing.

However, although all the YNAB rules made sense for me, using the software was a lot to wrap my head around. So, I participated in some of their webinars, actually followed along in the software with the fake budgets YNAB set up, and then it all started to click.

Once I fully rounded the learning curve, we officially started tracking our finances in YNAB (or rather I did, and I started giving my husband weekly updates or so) and began to get the clearest picture of our monthly budget we’d ever had.

Starting to Save and Building a Buffer

Next step was to save and create a one-month buffer so that we use last month’s income to pay the upcoming month’s bills.

Lucky for us, our buffer started off on a good foot since I had started saving up quite a bit at one of my more profitable jobs that left us with a decently-sized emergency fund that we didn’t have to touch.

However, even with a good size initial deposit to that buffer category, this did take a few months to work on, which the YNAB training materials predicted.

As our budget allowed we’d put a couple of hundred dollars in one month, then another good size chunk in one of those months with three pay periods (such a boon to your monthly budget if you earn bi-weekly pay!), a good chunk after receiving some Christmas money, and by the end of February we were there!

Now we had an emergency fund with a few months of expenses should something disastrous arise, a buffer, so we’re not spending money before we even make it, and a good grasp on our finances.

On top of the actual financial benefits we built, we also got the bonus of a real sense of security in our finances, which was a great first milestone to continue our progress.

Rainy Day Funds for Unplanned Expenses

In addition to building a larger emergency fund, we also started building up our rainy day funds for things like car repairs and home maintenance.

Those funds were a huge godsend when our sewer line backed up into our house, and we had to call Roto-Rooter on a Saturday afternoon to take care of it. WHEW!

While no one wants to spend $450 on Roto-Rooter’s services, having the money sitting right there in our bank account that was specifically set aside for fiascos like this was a whole lot less of a gut punch than it would’ve been had we not planned properly.

A Contingency Plan

Meanwhile, throughout our budgeting journey, I was working away at my day job getting more frustrated every day with how the company ran and how I wasn’t getting to do the type of work I wanted to do.

This dissatisfaction led to me picking up freelancing gigs on the side (i.e. in the morning before work, during lunch, and often late into the night after work) in the hopes that I’d be able to make the leap from my 9-to-5 to being a full-time business owner.

So, for our next budgeting goal, we set out to develop an agreed upon contingency plan with action steps to take if I wasn’t successful in my business after taking the leap.

My contingency plan looked like this:

- If I’m not making $1,300 per month within six months from my start date, then I will look for part-time employment to make up for the difference.

OR

- If we’ve used $9,000 from our savings, I will:

- look for a part-time job relevant to my interests or at a place with a worthwhile discount

- sell my car and buy a much cheaper one (or sell some other asset that we have)

AND

- If we’ve used $12,000 from our savings, I will look for a full-time job.

So now we had all this in place:

An Emergency fund, buffer savings, a strong grasp on our finances, rainy day funds, and a contingency plan.

Moonlighting Well into the Evening

As I worked to make the transition to being a full-time business owner, I continued to take on side projects, which was work I truly loved doing with steady clients I enjoyed working with.

This period of transition was a busy time in my life, but it allowed me to build up my business accounts and get a solid financial foundation in place that would allow me to invest in things like contracts and invoicing software.

But even though I had financially prepared my business well and checked all the boxes to make this plan work, I still didn’t feel ready to make the leap and just couldn’t give myself permission to do it!

One day my husband came home and nonchalantly asked, “So when are you actually quitting your job?” Turns out that was just the push I needed.

Just by him acknowledging that “oh yeah, we’re both on board with this” (duh we were, we both worked on this plan together for a while), I was finally ready for it.

Shortly after that, I talked with my boss and asked if I could go down to part-time, which they were open to, and from there, things kept falling into place for me to make the switch to working for myself full-time.

I was kicked out of my desk at the office to make room for a new person, though not someone in my exact role, so I had to move to working from home.

Then, my husband decided to leave grad school (turns out academia was not for him!) and we decided it would be best for us to move back home to Louisville and figure out what we wanted for our lives since that’s where we wanted to end up anyways.

Eventually, I left my previous company as an employee and handed over my responsibilities for marketing their business, but kept them on as a freelance client working on design for one of their product lines. Over a year later and I’m still working with them on a freelance basis to grow that product, and it’s been a great working relationship.

How I Use YNAB in My Business

As you might have guessed since YNAB was the tool that helped set us up for great personal financial security, YNAB has also been crucial in how I manage and track money for my business, and I’ve set it up the same way as our home budget.

When I’m paying myself, I pay myself with the money I made last month, and when I’m buying things or putting money towards annual business expenses, I also use the money I earned last month.

I also save up for rainy day business funds like office supplies, hardware, education, which makes it a little more fun than our household budget.

Recently, YNAB saved my butt big time when my laptop decided to kick the bucket. There was already a good chunk of change sitting in the computer replacement fund, and it almost covered the full cost of the laptop! WHEW!

In addition to unexpected expenses, these funds also help me budget for annual costs I know I’ll be paying for like my Dropbox subscription, paying for my accountant to do taxes, and renewing my hosting. But most importantly, it helps me set aside money for taxes and not dip into that money for stuff like buying more fonts or courses. (But I did create a font budget!)

Why YNAB?

Beyond all the benefits I’ve personally experienced from using YNAB, I love the organizational aspects in that I’m able to keep my household and business budget entirely separate – it’s just like logging into your work email and your personal email.

I also like that YNAB emphasizes planning as opposed to many other budgeting programs I’ve tried that focus more on looking back to see what you spent. Sure, YNAB might not be as pretty to look at as Mint, but for me, this tool is all about making me feel in control and being super accurate with where I’m putting my money.

YNAB will automatically pull your expenses in from your any bank accounts you link, but I prefer to use the old-school version where you have to input every transaction because I like having a granular view of things. It helps me to really FEEL where we’re spending our money, but I love that there are options that you can use to fit your individual preferences.

Now that I’ve shared my story in using YNAB, I don’t think it’s a secret to say I love it and highly recommend it if you’re looking for a tool to give you peace of mind with your finances at work or home.

You know what? YNAB jumpstarted me into self-employment too. I seriously couldn’t have done it without it. I’ve never regularly put aside money for big ticket items before IN MY LIFE! I feel so much more confident about my finances with YNAB in my tool box! Great post. Thank you.

YES! It’s such a confidence builder!!

This is such a great article, Jessica! I would love to chat about YNAB when we meet up for coffee soon. 🙂 I’m inspired by your story to get back on the budgeting train!